FTSE-listed multinationals, household name private companies, large local authorities, NHS Trusts and SMEs are collectively saving millions off their bottom line, simply by adopting a systematic approach to fleet management with the help of the free, government-backed Driving for Better Business programme.

Driving for Better Business has engaged with thousands of businesses, which collectively employ millions of staff, in its mission to improve the levels of compliance for those who drive or ride for work by demonstrating the significant benefits of managing work-related road risk more effectively.

Organisations report 12 common measurable business benefits:

- Collisions/at-fault incident claims car/van

- Collisions/at-fault incident claims HGV

- Reduced speeding penalties?

- Lower

- cost of maintenance

- Fleet utilisation

- Reduced fuel consumption

- Idling

- Insurance premiums

- Emissions

- Insurance claims

- Public complaints

Some of their stories are shared – including the challenges they faced, how they met those challenges, and the benefits they’ve seen as a result of engaging with the free Driving for Better Business programme – on the DfBB website: https://www.drivingforbetterbusiness.com/business-benefits/

Highlights include:

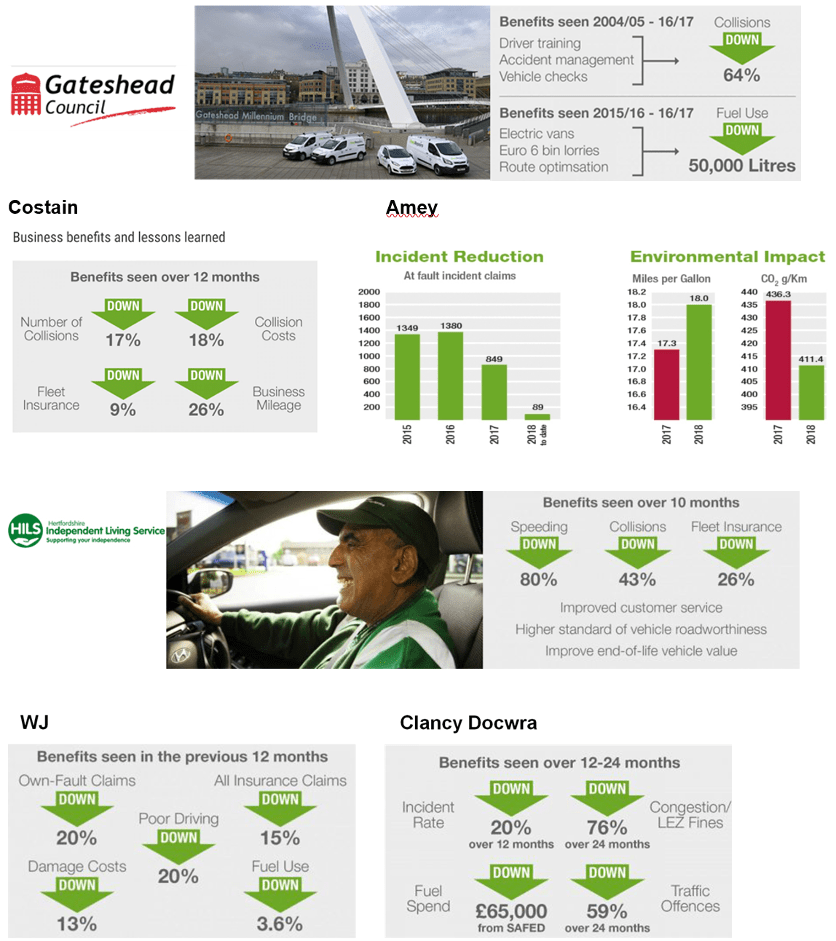

Gateshead Council which saved 50,00 litres of fuel over a 12-month period – at roughly £2 a litre, a saving of around £100,000. It reports the number of collisions down 64% over the periods 2004/5 and 2016/17

JHC Logistics, the husband-and-wife team behind 12 million parcel deliveries a year through Amazon, DPD, DHL and Yodel. A saving of more than £1million in insurance costs for a fleet of some 700 vehicles, and 80,000 litres amounting to almost £160,000 in fuel prices today

Balfour Beatty, which manages the road risk of around 12,000 drivers. Over the last 6 years the construction company reported their crash frequency rate fall by 63% – equivalent to £570,000 of annual benefits.

Amey, responsible for 11,000 drivers, reported at-fault incidents down 38% over 12 months from 1380 in 2016 to 89 in 2018

Tarmac, part of the CRH group, saw a decrease in speeding of 10% across all geographical areas (25% in the North and Scotland) and its insurance claims drop by 48%. A continued focus on risk management has seen insurance claims fall consistently year on year, from 589 in 2016/17 to 255 in 2019/20 – a reduction in claims of nearly 50%.

WJ, the UK’s leading road marking reported all insurance claims down 15%; own fault claims down 20%; fuel use down 3.6%

Infrastructure specialists The Costain Group plc recognises the importance of managing Occupational Road Risk relating to its employees and the safety of all other road users, as seriously as any other business-related activity. Through its engagement with the Driving for Better Business

scheme, it reports collisions down 17%; collision costs down 18%; fleet insurance premiums down 9%

Clancy Docwra is one of the largest privately-owned construction firms in the UK. Reported a saving of £65,000 on fuel, congestion charge fines down 76% and traffic offences down 59%

Hertfordshire-based Hills Independent Living Service that provides Meals on Wheels in the community, brought speeding offences down 80% and collisions down 43% over 10 months. It saved 26% on fleet insurance

McLaren Automotive produces high-performance vehicles, with high brand recognition, meaning that any failures in these areas have the potential to be dangerous, costly, and cause serious reputational damage to the brand. With a focus on identifying risks and raising driving standards, the supercar company managed to get its insurance claims down 54% over 36 months; the cost of fleet insurance down 21% per vehicle per year over 10 months since 2014 with further reductions anticipated; and complaints from the public down 100% over 18 months.

“These organisations are the tip of the iceberg and there are countless more case studies on our website,” says Simon Turner, campaign manager for Driving for Better Business. “Very few organisations can operate without using the roads and around 20 million people are estimated to drive for work in some capacity – from professional drivers to those who make occasional work journeys and includes company owned vehicles and privately owned vehicles.

“Driving for work is one of the highest-risk activities that most employees undertake. It is also a significant cost to the business. Employers that manage this issue well have peace of mind that they are legally compliant, are regarded by staff as better places to work, and perform at a much higher level of efficiency than those that don’t.

“There is clearly a strong business case for managing work-related road safety. Fewer road incidents mean fewer days lost to injury; fewer repairs to vehicles with vehicles out of action; fewer missed orders and overall reduced running costs. Now is the time to become better informed and start getting the benefits of better practice.”

Dave Conway, Road Safety Manager at transport and construction company FM Conway, says: “If you are going to persuade a business to adopt these systems there needs to be a business case. Within the first year of adopting the system, we found ourselves with a £56,000 reduction in our fleet insurance premium. That’s a sound business case.”