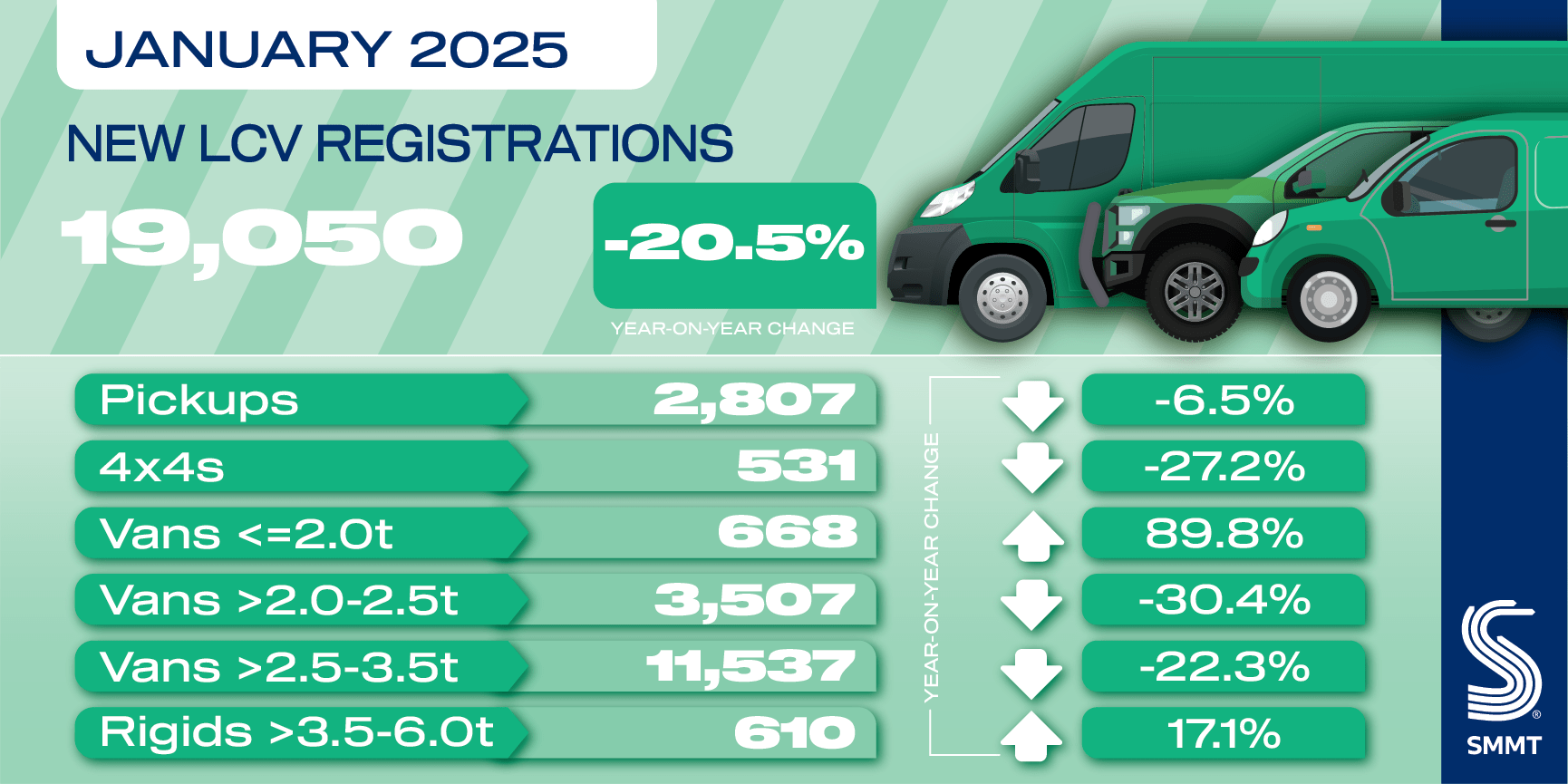

Britain’s new light commercial vehicle (LCV) market fell by -20.5% in the first month of 2025 with 19,050 vans, pick-ups and 4x4s registered, according to the latest figures published today by the Society of Motor Manufacturers and Traders (SMMT). A second consecutive monthly decline follows robust growth in 2024, and is set against a tough economic backdrop and weakened business confidence to invest.

Falling demand hit all but one segment, with small van registrations recording the only increase, up 89.8% to 668 units but still just a fraction (3.5%) of the market. Registrations of the largest vans were down -22.3% to 11,537 units – representing 60.6% of the overall market – while those of medium vans fell by -30.4% to 3,507 units. In the smaller volume segments, meanwhile, 4x4s and pick-ups fell by -27.2% and -6.5% respectively.

Battery electric van (BEV to 4.25T) uptake rose for the fourth consecutive month, supported by the continuation of the Plug-in Van Grant, up 12.4% to 1,464 units – an overall market share of 7.6%.1 Further growth is anticipated across the year, with the latest outlook published today suggesting BEV volumes (to 3.5T only) will reach 33,000 in 2025 to command a 10.6% share of registrations – substantially below the 16% mandated. At the same time, the overall market is expected to contract by -1.2% to 348,000 units.

Manufacturers have invested massively in EV innovation with more than half (33) of all van models on the UK market available as zero emission, providing operators with an impressive array of choice.2 Unless government backs its EV regulation with an ambitious fiscal and infrastructure strategy, however – one that includes mandating faster chargepoint rollout that meets the specific charging needs of vans compared with cars – operators will lack confidence to run their fleets on zero emissions.

With the new year now underway, government’s review of the Zero Emission Vehicle Mandate must ultimately deliver measures and flexibilities to support the industry and the van buyer.